Welcome Austrian reader!

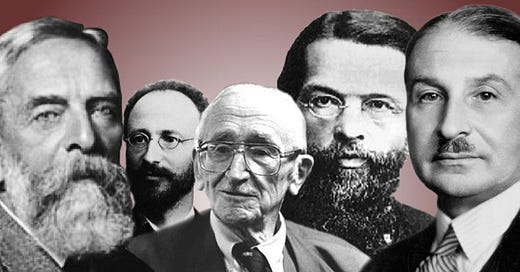

In today’s post we’ll be introducing the Austrian School of Economics.

The cornerstone of this blog, the guide to analyze global events.

Hope you enjoy it!

“The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.”

― Friedrich A. Hayek, The Fatal Conceit: The Errors of Socialism

Introduction

A Humanistic and Dynamic Approach

The Austrian School of Economics stands out as a profoundly humanistic and multidisciplinary approach to understanding economic phenomena. Unlike the stereotypical, robotic view of a profit-maximizing “homo economicus”—central to many Neoclassical models—the Austrian School begins with a realistic portrayal of human beings, focusing on men and women as they truly are.

This perspective rejects the mathematical models that dominate various versions of the Neoclassical School, from New Keynesians to Chicago School theorists, and instead emphasizes a more dynamic, entrepreneurial approach.

The Entrepreneur as the Central Figure

The protagonist of all social phenomena is the entrepreneur. This is understood as a human being endowed with an innate capacity, both creative and coordinating, to discover worthwhile goals and act to achieve them. This focus on entrepreneurship leads to their conception of society as a spontaneous order, a constantly evolving competitive process that is never in equilibrium and cannot be centrally designed or controlled.

Their research program focuses on analyzing the dynamic processes of social cooperation that characterize the market, emphasizing the critical role of entrepreneurial function and the institutions that make social life possible.

Understanding the Market

A Process of Creativity and Coordination

The Austrian School’s approach to the market differs fundamentally from other economic theories. While many analyses view the market as a system searching for equilibrium—either plagued by failures (as neo and post-Keynesians argue) or achieving Pareto efficiency (as the Chicago School suggests)—Austrian economists see the market as a dynamic process. This process is driven by entrepreneurial creativity and coordination, and by its very nature, the market can never achieve a static state of optimality. Instead, the market is dynamically efficient, continually fostering innovation and adaptation.

For the market to function effectively, it is crucial that the state’s institutional coercion, such as interventionism and socialism, does not impede entrepreneurial activities or the free appropriation of the fruits of such activities. This requires a strong respect for private property and a legal framework governed by the rule of law, with a government of limited powers.

Capital, Money, and Economic Cycles

One of the most significant contributions of the Austrian School is its theory of capital, money, and economic cycles. This theory argues that when credit is expansively granted without being backed by an actual increase in voluntary savings—a practice enabled by the fractional reserve banking system under central bank supervision—it leads to a fictitious and unsustainable “lengthening” of productive investment processes. This scenario creates speculative bubbles, resulting in severe real investment errors as investments become disproportionately capital-intensive.

As the inflationary process is amplified by credit expansion, it will inevitably reverse, leading to an economic crisis or recession. During such downturns, the errors in investment become evident, resulting in unemployment and the need to liquidate and reallocate misallocated resources.

Contrary to the views of Chicago theorists, who attribute crises to external factors, or Keynesians, who see them as inherent to the market economy, the Austrian School argues that these crises are rooted in a defective institutional design—specifically, the existence of fractional reserve banking. The Austrian solution involves privatizing money (returning to a pure gold standard), enforcing a 100 percent reserve ratio for demand deposits, and eliminating central banks, which are seen as remnants of socialist planning in the monetary realm.

Predicting and Understanding Economic Crises

The Austrian School’s insights have been proven almost prophetic in predicting major economic events. Ludwig von Mises and Friedrich A. Hayek, for example, were among the few economists to foresee the onset of the Great Depression in 1929, attributing it to the monetary and financial excesses that followed the establishment of the Federal Reserve in 1913. Similarly, they predicted the inflationary recession triggered by the so-called oil crisis of 1973, which undermined Keynesian economic theories.

In more recent times, Austrian economists repeatedly warned of the credit bubble and “irrational exuberance” that characterized the period of the so-called “new economy” from 1992 onwards. These warnings culminated in the severe financial crisis and economic recession that the world faces today.

The Critique of Scientism in Economics

Also noteworthy is the critique of the bad application of the methods of natural sciences and physics to the field of economics ("scientism" in Hayekian terminology), as well as the development of an a priori deductive methodology that adequately links the world of (formal) theory with the world of (empirical) history.

The use of mathematics in economics is rejected as it is a formal language that emerged from the needs of physical science and formal logic, where the assumption of constancy applies, and where entrepreneurial creativity and the passage of subjective time (not "spatialized") are absent. Only the verbal language, evolved by human beings in their daily entrepreneurial endeavors, is considered suitable for the scientific analysis of the realities of spontaneous market orders, which are never in equilibrium.

Conclusion

Fundamental Economic Perspective

In conclusion, for Austrian School economists, the fundamental economic problem is not technical or about maximizing a “known” and constant objective function under “known” and constant constraints. Instead, it is an inherently economic problem, as understood by the Austrians: it arises when ends and means are numerous and competing, knowledge about them is dispersed among countless individuals and is continually being created ex novo (from scratch). This ever-evolving context means that not all existing alternatives can be known, nor those that will be created in the future, nor the relative intensity with which each one is to be pursued.

The Austrian School’s approach offers a profound and insightful perspective on the nature of the market and the role of entrepreneurship, providing valuable tools for understanding and navigating the complexities of modern economies.

Are you a new Austrian reader? Do not hesitate to follow me.

And do not forget to check-out the About you page as well.

Disclosure: Not Investment Advice

The content provided in "Austrian Goggles" is for informational purposes only and should not be considered as financial, legal, or investment advice. The opinions expressed are those of the author and are based on research and analysis of current market conditions. While we strive to ensure the accuracy of the information presented, there is no guarantee of its completeness or reliability. Any investment decisions you make are your responsibility, and you should consult with a qualified financial advisor before making any investment decisions. The author and contributors to this newsletter are not liable for any losses or damages arising from your use of the information provided.